Cryptocurrency is a type of digital asset created using cryptographic techniques, enabling people to buy, sell, and trade it safely. Cryptocurrencies can move around without a monetary authority, like, a central bank. Bitcoin is a famous cryptocurrency. The blockchain is a decentralized ledger that can’t be altered and helps cryptocurrencies like Bitcoin Finixio Ai and others operate more efficiently. It retains an unchangeable record of all transactions and identifies who owns what.

What is Bitcoin?

Bitcoin is a digital currency that can be transferred on the peer-to-peer Bitcoin network.

Bitcoin is a decentralized digital currency that operates on a peer-to-peer network and has no single administrator or owner. It is a component of the cryptocurrency. Because it functions as money as well as a transaction that is independent of the control of any one person, group, or organization, this digital currency eliminates a requirement for a third party to be involved in financial dealings. 2009 was the year that an anonymous developer or group of anonymous developers under the alias Satoshi announced Bitcoin to the general world. There are a number of cryptocurrency exchanges where Bitcoin may be purchased. This is because Bitcoin is the most widely used cryptocurrency in the entire world. To put it simply, it is a sort of digital currency that is not overly difficult to grasp.

Over the course of the last several years, trading in cryptocurrencies has picked up a significant amount of steam. Although cryptocurrencies were announced as an experimental technological test, now it is a worldwide event. In many countries worldwide, cryptocurrencies have gained popularity through investment and trading. That’s why many trading platforms are available in this market. The news spy is one of those secured platforms.

How to choose a Bitcoin exchange?

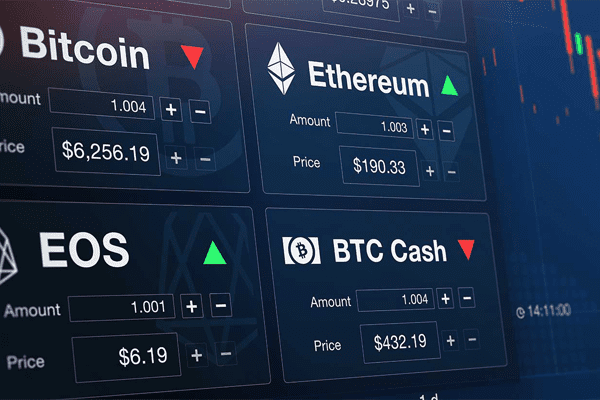

It is common knowledge that thousands of different digital currencies are currently in circulation, and that number continues to grow by the month. New investors in cryptocurrencies need to begin by deciding how they would invest their money and where they will keep their digital assets. In addition to this, new investors need to figure out how and where to conduct transactions with cryptocurrency.

- Transparency of exchange: Because cryptocurrencies such as Bitcoin are not legally controlled, trust and transparency are essential. In every country, a host of deals are available to identify a dependable exchange and calculate the audit information of the conversation. Transparent discussions release cold storage addresses and give disclosures on systems to verify digital currency reserves.

- Coins and Tokens: It is essential that an investor also consider the tokens and coins currently traded on the exchange. At the same time, evaluating the frequency of coin introduction is vital. If there is a delay in launching a digital currency, such as Bitcoin, the investor can lose an opportunity. So, an exchange must be active and continuously adjust to market movement. Similarly, obsolete and unnecessary tokens and coins must be discharged from trading.

- Ease of trade: Another critical fact to consider when choosing an exchange is the ease or smoothness of work. The settlement and turnaround time for the transfer of bitcoins or digital currencies also need to be evaluated. Few businesses offer lock-in prices. This price system fixes the buying price of the cryptocurrency until delivery.

- Higher security: It is essential when choosing an exchange to always go with higher security. Additionally, it is essential for investors to store the vast bulk of their cryptocurrency holdings in a cold wallet or another form of offline storage facility. It is often even a good choice for staked coins. Exchanges need to do the same with their digital assets.

- Exchange reputation: The exchange’s reputation is the most subjective. The deal can be glossy if a business invests heavily in media firms to build a reputation. So, the goodwill of the sale must be seriously evaluated by the investors. For the same thing, it is recommended to conduct accurate research, seek the guidance of professionals, and engage in discussion. In order to develop a robust community, investors should discuss the lessons they’ve learned.

Rather than these, there are some more factors available to consider during an exchange. Like location exchange, fraud alerts, order book volume, exchange fees, etc. Choosing exchange is very important for crypto investors. That’s why they need to know about crypto exchange. Hope this article helps investors to understand how to choose an exchange.