Because they are not lucrative, businesses do not go out of business. They declare bankruptcy because they run out of money and are unable to make their payments when they are due. Because they need rising quantities of working capital to sustain expanding investments in inventory and accounts receivable, profitable, growing businesses may also run out of money. You may stay clear of these pitfalls by using the working capital ratio.

Table of Contents

What Exactly Is Net Working Capital?

The company’s readily usable assets are referred to as net working capital. From a mathematical perspective, it is a ratio that indicates the gap between an organization’s assets and liabilities. An organization’s balance statement includes the NWC. Finding out how liquid a company’s assets are at any particular time is the basic objective of capital. The company’s capacity to pay its obligations and operating costs will be determined by its liquidity.

Net working capital may be “net-zero,” negative, or positive at all times. A corporation with a positive net working capital can pay its debts while still having money left over for investments, growth, commercial operations, and even crises. You need to understand these subtleties so that later you don’t have to think about how to borrow money from cash app on iPhone (for example) after your company goes bankrupt.

What Exactly is the Net Working Capital Ratio?

The total net amount of working capital is the net working capital ratio. It is meant to show if a company has access to enough net money to continue operating soon. The net working capital ratio may be calculated using the formula below:

Current assets minus Current liabilities equals the net working capital ratio

Because it does not link the entire amount of positive or negative results to the number of current obligations to be paid off, as would be the case with a real ratio, this assessment merely gives a rough indication of the liquidity of a corporation. Additionally, it does not compare the deadlines for paying off current obligations and liquidating current assets. Therefore, if there is not enough immediate liquidity in current assets to settle the immediate obligations of current liabilities, a positive net working capital ratio may result.

What Elements Affect Net Working Capital?

Credit Line

The net working capital of a corporation may be impacted by the condition of its credit line. Your credit line is unquestionably an asset, but the balance, not the overall credit limit, is what counts as the asset. This is so that a credit line that has been used up may no longer be used to pay debts; it becomes a liability. Credit lines should only be used to finance short-term obligations.

Payment Anomalies

Standard deviations, like any correct data analysis, provide a deeper knowledge of how the data behaves. These are anomalies in payments for net working capital. For instance, a significant payment on accounts receivable that occurs just once a year is not a reliable indicator of net working capital. Neither is a big payment that occurs just twice a year.

Current Liquidity

An asset cannot be regarded as working capital if it cannot be liquidated on demand or is not liquid. Liquidation may sometimes cost the firm a lot of money. All of these aspects affect whether something may be categorized as working capital. Even delayed or longer-term account receivables wind up being removed from a company’s assets because they are inaccessible.

Inventory Revolving

The performance of the inventory has a significant influence on working capital. The overabundance of items is more of a liability than a tool for making money. A reliable stream of lucrative revenue may be generated by ensuring that your warehouses or inventories have a regular flow of goods entering and leaving. However, the inability to sell the stock results in greater dues that reduce cash flow.

Debts, Both Long And Short Term

It’s critical to realize that short-term loans count as liabilities when determining working capital. Long-term loans do not, nevertheless. This is so that assets won’t be immediately depleted to pay off long-term obligations, which are anticipated to be repaid over a longer period. However, short-term loans may wind up becoming a significant burden.

How to Calculate the Net Working Capital Ratio

There are situations when the net working capital ratio is specified wrongly. It may be described as current obligations less current assets. Working capital is calculated using that calculation rather than the net working capital ratio.

Current assets mature in less than a year. Current liabilities are obligations that must be repaid by the company within a year. The ability of the organization to meet its present responsibilities with its current assets without needing to get further funding is the ideal scenario.

The most common types of current assets are money, marketable securities, receivables, inventory, and prepaid costs. Accruals, accounts due, and loans payable all fall under current liabilities.

You Should Increase Your Net Working Capital

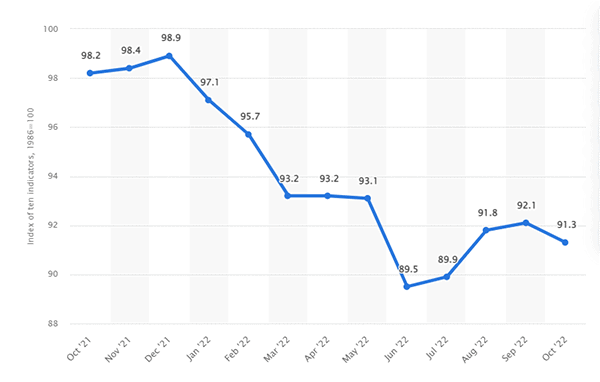

Some factors will help keep your business optimistic. Statistically, the U.S. small business optimism index is over 90%, which is slightly lower than before, but at the same time a remarkable indicator after the coronavirus pandemic.

You may increase your net working capital in a few different ways if your company consistently struggles to have a positive cash flow.

Boost The Ratio Of Your Inventory Turnover

Inventory graveyards may be overstocked warehouses. Look for strategies to optimize your inventory management so you can maintain safe stock without experiencing inventory bloat. Unless you’re selling at cost, inventory sold will always generate more revenue than inventory waiting to be sold.

Sell Off Long-Term Investments

Some assets, such as office and manufacturing machinery, are seen as long-term investments rather than short-term ones. Selling long-term assets for cash may increase your liquidity and relieve you of other related expenditures like storage and upkeep if you have a stockpile of unused ones (especially important for mothballed equipment that is not otherwise providing value).

Use Refinancing To Convert Short-Term Debt To Long-Term Debt

Although you will still need to factor in the amount of the debt due this year, converting short-term debt to long-term debt will increase NWC, giving you more money for investments, innovations, and savings that will help you pay off all of your debt more quickly.

Purchase Financial Software Instruments

Managing net working capital is one of many corporate operations that is made much simpler with the use of digital transformation technologies like artificial intelligence, sophisticated data analytics, and robotic process automation.

Bottom Line

The term “Net Working Capital” (NWC) refers to the financial gap between a company’s current assets and current liabilities. It serves as a gauge of a company’s liquidity and capacity to pay short-term debts and sustain ongoing operations. With a surplus of current assets over current obligations, a positive net working capital balance is attained, representing the optimum condition.