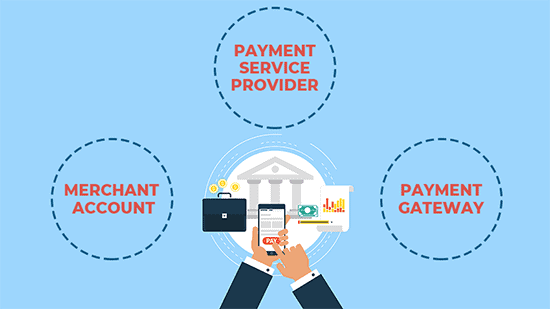

The capacity to make electronic payments is provided by a payment gateway. A payment gateway can give you a comprehensive billing system at a low cost whether you’re a local business. You won’t have to bother about engaging with online payments, following PCI compliance criteria, or locating a payment method.

Table of Contents

What is a Payment Gateway?

A payment system like Payu Hub is a complicated structure that allows online and offline retailers to accept card payment payments. It ensures that such transactions run smoothly by encrypting sensitive information and moving it between a purchaser, the online store, and a bank. The bank serves as a payment gateway, while the retailer serves as a payment portal.

As a result, the payment gateway initiates the interaction between the three parties involved in the transaction. It uses a variety of anti-fraud techniques and adheres to PCI compliance to assure that every transfer is secure.

The payment system is a level well above payment service from a technical standpoint. It accepts user data and, based on the transaction method selected, sends the money to the system in a language that it can comprehend.

Why Would You Want to Create A Bespoke Gateway?

There are a variety of ready-to-use payment options that you can easily integrate into your store. None of these alternatives, however, can provide you with complete control over online payment. Furthermore, there’ll always be things you wish to tweak or add.

A payment service provider brings numerous advantages, particularly for small-business operators. Here is what What exactly does a payment solution provider do for you;

Complete Solution

For entrepreneurs who want to take payments quickly, financial services include a plug-and-play option. In most cases, you may sign up the same day and begin collecting online payments. Since the payment service provider’s risk is lower than that of the retailer importer, there is no lengthy verification process.

Price

It can be difficult to secure a fair deal from a retail acquirer whether you’re a new local firm or you’re regarded as a “high-risk merchant.” You don’t have to bother about being scammed off by payment service providers because they charge the same flat amount to all of their users. Your payment gateway will also cover fees related to processing payments, like PCI compliance fees. Companies can get tranquility and certainty by knowing exactly how much they will pay for money transfers.

Stability

When this refers to payment processing, possessing a minimum vetting process can be a double-edged dagger. If the payment gateway believes its conduct to be too dangerous, businesses that use payment service providers are much more prone to encounter interruptions in the form of account freezes or dismissals.

For a local company, losing the ability to receive electronic payments can be disastrous, so it’s crucial to be aware of the danger before registering.

Customer service

Whenever you deal with a merchant importer, you’re typically dealing with somebody who is familiar with your company and payment habits.

Your customer support interaction with a payment service provider this way is less targeted to your individual business needs because you’re one of many retailers inside a business account.